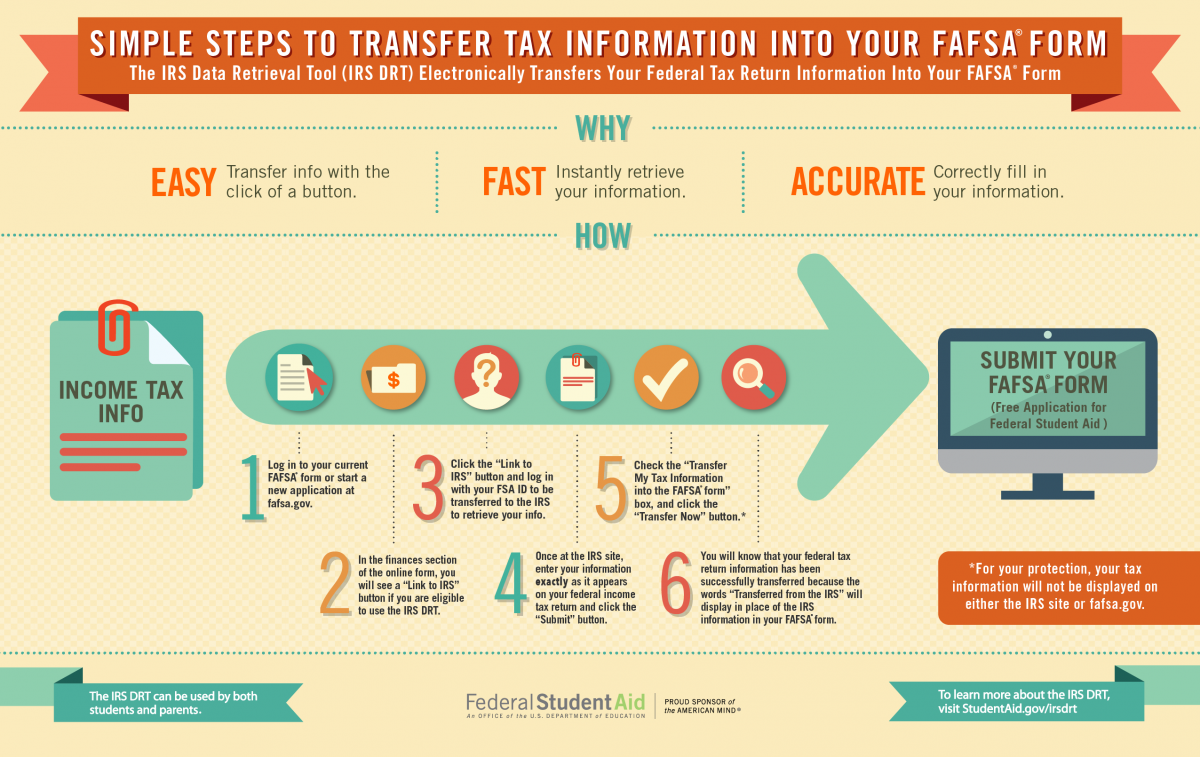

The Internal Revenue Service Data Retrieval Tool (IRS DRT) automatically transfers tax information into the FAFSA form. Be sure to consider this option if it's offered to you. If you requested an extension on filing your taxes and didn't file until September or later, find out when your tax return information will likely be available using the IRS DRT.)

Using the IRS DRT saves you time and effort:

-

You don't have to find your tax records.

-

You don't have to worry about making mistakes entering your tax information on your FAFSA® form.

-

You may not need to provide an IRS tax transcript or a signed copy of your income tax return if you're selected for verification.

Here's how the IRS DRT process works, assuming your tax information is available:

-

The IRS DRT takes you to the IRS website, where you'll need to provide your name and other information exactly as you provided it on your tax return. Some data will be prepopulated from your FAFSA form.

-

You'll see a page on the IRS site indicating that your tax information is available. (You won't see the actual information for security and privacy protections.) You can import your data into the FAFSA form or cancel your request and return it to the FAFSA site.

-

If you choose to import your information into the FAFSA form, you'll find that on the FAFSA site, instead of your tax information being displayed, you'll see "Transferred from the IRS" in the appropriate fields. You won't be able to make changes to those answers.

If you still need to obtain a copy of your tax transcript, you can request the IRS Get Transcript Service at irs.gov/transcript.