What is a 1098-T Tuition Statement form?

This form is provided to help you or the person who may claim you as a dependent determine whether or not you may be able to claim an educational credit on your taxes each year. IRS Form 1098-T is a required informational Tuition Payments Statement provided by colleges and universities for the purpose of determining a student's eligibility for the Hope and Lifetime Learning Education tax credits. To help you determine your eligibility, please review IRS Publication 970, ask your local IRS office, or contact a local tax advisor to help you understand what this form may mean for you if you receive one.

How can I get my 1098T?

Please follow the steps below or use the following link to our Ask the Viking solution: https://ask.salemstate.edu/kb/how-access-my-1098-t

- Log into Navigator.

- Once at the Student Homepage, click on “Financial Account”.

- Located in the menu bar, click on “Student Accounts”.

- Click on the “Click Here” link to access TouchNet.

- Complete required Multi-Factor Authentication (MFA) steps. If this is your first time logging in, you will need to choose a Multi-Factor Authentication option to receive codes to login. Click here for a how-to guide on setting up and using the MFA.

- Once in TouchNet Click on the “My Account” link

- Select the ‘Statements’ option

- You will then have the option to select 1098-T Tax Statements and click the ‘View’ button.

- You will be redirected to ECSI, a third-party company that has partnered with Salem State to provide the 1098-T. This is where 1098-T statements are stored. From here, students can view, download, or print their 1098-T statements.

How can I authorize another user?

Please use the following link for more information on an adding an authorized user: https://ask.salemstate.edu/kb/how-assign-authorized-user

How do I receive an electronic copy of my 1098-T?

If eligible, a 1098-T form will be made available to you no later than January 31.

Starting with your 2020 Tax form, you can opt-in to receive an electronic version of your form instead of a mailed copy. This new option allows you to view your form at any time through your Navigator account. The deadline to sign up for e-Consent for your 1098-T is December 31 of the tax year (Example 12/31/2020 for tax year 2020). If you opt-in after this date, you will receive a paper copy to your domestic mailing address on file. Electronic copies will be available on January 31st and paper copies will be postmarked by this date.

To submit your consent please follow these steps (link to PDF at the bottom of the page):

- Log in to Navigator

- Once at the Student Homepage, click on "Financial Account"

- Located in the Menu Bar, click on "Student Accounts"

- Click on the "Click Here" link to access your TouchNet Account.

- Complete required Multi-Factor Authentication (MFA) steps. If this is your first time logging in, you will need to choose a Multi-Factor Authentication option to receive codes to login. Click here for a how-to guide on setting up and using the MFA.

- Click on the Home button then click on “Consent and Agreements” button on the right-hand menu.

- Once in your “Consents and Agreements” page, you will be able to view your consents. Click on “Change”.

- A pop-up will appear. Please read the section carefully and accept the option you prefer.

- Accept Consent to agree to paperless. I Do Not Consent to return to paper copy.

What are qualified tuition and related expenses?

- Graduate & Undergraduate Resident and Non-Resident tuition

- Special class fees

- University fees

The IRS gave Colleges and Universities the option to either report “Box 1 Payments received for qualified tuition and related expenses” or “Box 2 Amounts billed for qualified tuition and related expenses.” Up through 2017, Salem State University chose to report Box 2 qualified amounts billed. As of 2018, the IRS has required the reporting method be Box 1 Payments received.

What are Non-qualified expenses?

- Room and Board

- Insurance

- Books (not required for enrollment or attendance at an eligible educational institution)

- Non-credit course fees

- This is not a complete list of QTRE, these are the most popular items

What do the boxes represent?

Box 1 Payments Received reflect all payments posted to your student account during the calendar year – January 1 through December 31 regardless of the semester to which those charges apply. Please note that Salem State University begins billing students for spring tuition and fees in November/December in advance of the spring semester. For example, if you pre-registered for the spring semester, any payments made in November/December towards the Spring term will be included in Box 1 of your 1098-T. Box 7 will be checked if you have any “amounts for an academic period beginning January – March.” Refer to Publication 970 on the IRS Publication 970 for how to report these amounts.

Box 5 Scholarship and/or Grants represent those disbursed by financial aid.

Box 8 Checked if a student is considered to be carrying at least one-half the normal full-time workload for their course of study for at least one academic period during the calendar year.

Box 9 Checked if a graduate student.

Why didn’t I receive a 1098-T form?

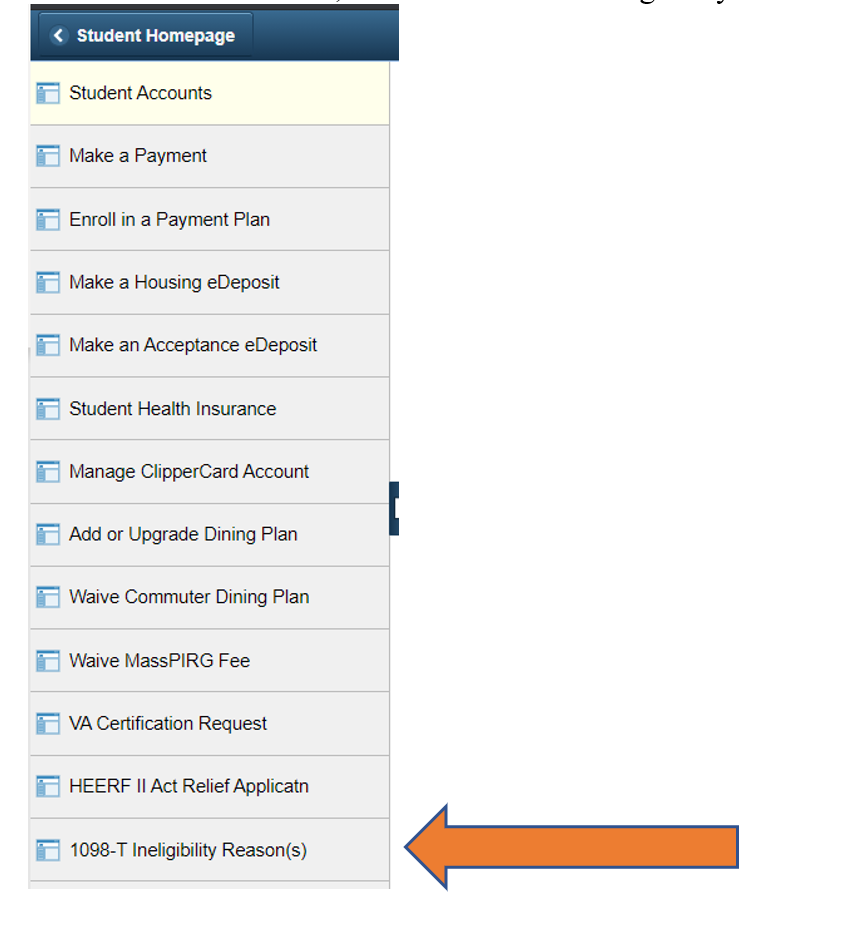

To find out why you did not receive a 1098-T form, please follow the steps below to view 1098-T Ineligibility Reasons.

- Log in to Navigator.

- Once at the Student Homepage, click on "Financial Account".

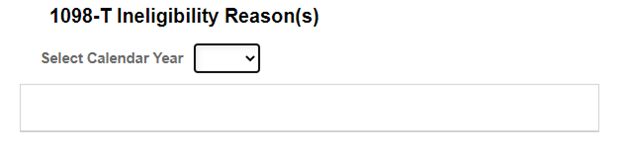

- At the bottom of the list, select the 1098-T Ineligibility Reasons.

- Select the year you are looking for and the information will display.

Please review an explanation of the reasons below or possibilities of why you may not have received a 1098-T:

- Enrollment: you did not get academic credit for course.

- Paid by Fin Aid: A 1098-T form will only be produced if there is more payment activity (Box 1) than amount paid by certain types of financial aid (Box 5) on an account during the calendar year January 1 to December 31.

- Citizenship status: our system has no citizenship status in system for student or coded as Non-Resident Alien. If you have questions on your eligibility status, please review IRS Publication 970, ask your local IRS office, or contact a local tax advisor to help you understand what this form may mean for you if you receive one.

- No messages for this calendar year: if you have made a payment in this calendar year, you may have a 1098T. Please log in to your Navigator account to review. If you did not make a payment in this calendar year, you would have no 1098-T available.

- Your address in our system is not current and the form was returned by the post office.

Why is a 1098-T not generated for Non-Resident Aliens (international students)?

Salem State University is not required to supply Non-Resident Alien students with a form 1098-T according to the guidelines established by the Internal Revenue Service. However, one can be generated upon student request and the information will be forwarded to the IRS. You should refer to Publication 970 on the IRS website to determine if you are in fact eligible to take an educational credit. Please note: to have a 1098-T generated you must have a valid social security or tax identification number (ITIN) on file with the University.

Updating your Social Security Number with Salem State

If you need to update your SSN or TIN with the University, please fill out a W9-S Form through the university's web form to request an update.

How can I get in touch with ECSI directly?

ECSI is a third-party company that has partnered with Salem State to provide the 1098-T tax document. Call 1.866.428.1098 with questions about your 1098-T tax document. Customer Advocates are available Monday to Friday, 7:30 AM - 8:00 PM Eastern Time. You can retrieve general information about your 1098-T tax document using our automated service that is available 24 hours per day, 7 days per week. A live chat function is available using the link below.

You can also live chat with text by texting HELP at 888.996.3002.